BMW i Ventures Co-Leads Investment in New Electric Motor Technology: DeepDrive

Get Your Motor Runnin’

BMW i Ventures announces a co-lead investment in the $16.1M Series A round for startup DeepDrive. DeepDrive has developed a cost and resource efficient dual-rotor motor, extending the range of electric vehicles. Other investors include UVC Partners, Bayern Kapital with Wachstumsfonds Bayern, and Continental’s Corporate Venture Capital Unit. The company is also backed by renowned automotive manager Dr. Peter Mertens.

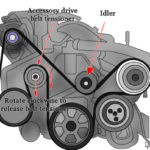

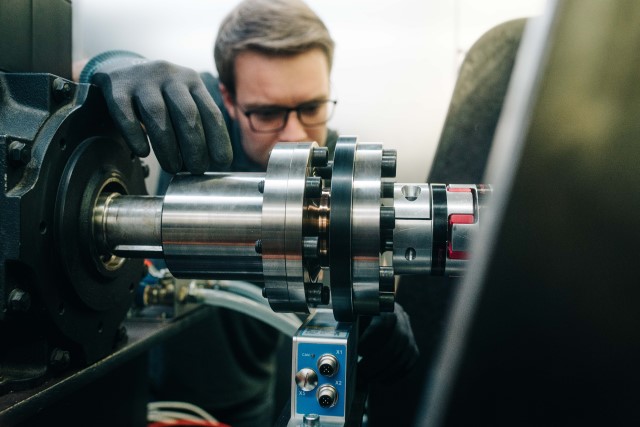

The radial flux dual-rotor electric motor includes power electronics and can be installed in any vehicle as a central drive or as an in-wheel drive. The patented technology increases the range of vehicles, achieves high torque density, is cost-efficient to manufacture and requires fewer natural resources; in turn, reducing environmental impact.

“With its patented and unique e-motor architecture, DeepDrive could set new standards for e-mobility,” said Marcus Behrendt, Managing Director at BMW i Ventures. “The highly efficient e-motors offer major advantages in terms of weight, cost and space. They enable the next generation of efficient and resource-saving electric vehicles. DeepDrive’s e-motor technology is designed for easy and cost-effective mass production. We are pleased that our involvement can help this new technology achieve a breakthrough.”

The DeepDrive team is working with eight of the top ten OEMs and is on track to bring its technology to production by 2026. Co-founder and CEO Felix Pörnbacher said: “We believe our technology will revolutionize vehicle electrification. With our dual-rotor technology, we are significantly more cost-effective and efficient on the road, shaping tomorrow’s electromobility. The demand for our development shows that we are on the right track. We would like to thank BMW i Ventures, Continental’s corporate venture capital unit, and the other investors for their confidence.”

With the fresh capital, the company plans to start manufacturing its motors, increase its headcount to respond to the high demand from OEM customers and win first series commitments.

About BMW i Ventures

BMW i Ventures is the venture capital fund of the BMW Group and is one of the most relevant venture capital investors in the automotive environment. Since 2011, BMW i Ventures has been supporting innovative and rapidly scaling start-ups in the automotive environment. The focus is on sustainable hardware and software solutions from start-ups in the transport, manufacturing and supplier industries. The fund successfully invested in sustainable industrial solutions (such as Boston-Metal, Natural Fiber Welding or BComp) and is involved in the success stories of over 60 companies (including Chargepoint (IPO), Kinexon, Motorway, Our Next Energy, Solid Power (IPO), Tekion, Turntide and Xometry (IPO)). BMW i Ventures is characterized by a high degree of agility and independence and offers young companies a high degree of flexibility. Marcus Behrendt and Kasper Sage are the Managing Partners. The company is headquartered in Mountain View, Silicon Valley, with offices in San Francisco and Munich.